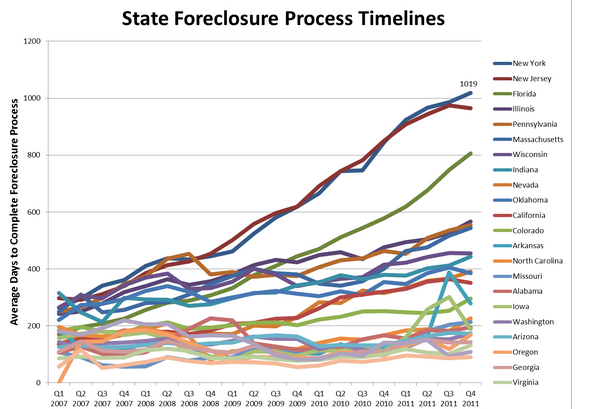

The average days to foreclose is up to 348 nationwide; over 800 days in New

York, New Jersey and Florida, this according to the 2011 year-end foreclosure report released last Thursday by RealtyTrac.

A total of 2.69 million foreclosure filings – including default notices, scheduled auctions and bank repossessions – were reported this year. The 2011 total foreclosure filings was 34% below the 2010 total; 33% below the 2009 total; 19% below the 2008 total.

Despite this decrease in 2011 total foreclosure filings, the U.S. housing market has not altogether escaped the foreclosure crisis, RealtyTrac said.

“Foreclosures were in full delay mode in 2011, resulting in a dramatic drop in foreclosure activity for the year,” Brandon Moore, chief executive officer of RealtyTrac, said in a press statement.

“The lack of clarity regarding many of the documentation and legal issues plaguing the foreclosure industry means that we are continuing to see a highly dysfunctional foreclosure process that is inefficiently dealing with delinquent mortgages — particularly in states with a judicial foreclosure process,” Moore added.

The artificial decrease in foreclosure activity in 2011 brought about by foreclosure processing delays will result to a corresponding double-peak in 2012, RealtyTrac said.

According to RealtyTrac, the double-peak in foreclosure activity in 2012 will result to the following:

1.Steady influx of foreclosure activity will also keep home prices from appreciating substantially during the year.

2.Increasing foreclosure activity will slowly push the available foreclosure inventory higher and this could be good news for buyers.

3.Legal issues, property maintenance costs and other issues complicating the foreclosure process will lead lenders to more likely approve short sales in 2012.

Whether you are a first time buyer, first time seller, empty nester, thinking about selling or buying a home, do contact the Guldi Real Estate Group. In Southern Maryland, the Guldi Real Estate Group is the number one real estate team.