Many struggling families are keen to avoid foreclosure, but they don’t qualify for HAFA guidelines. For most real estate agents, distressed real estate is an untread area, but there are a few agents who have chosen to become experts in the specialty. By versing themselves in the potential tools that might be available to their clients, they’re able to ensure that short sale transactions are an option for the families that come to them. A client of the Guldi Group found themselves in the same compromised position so many homeowners have been facing, but they walked away with $35,000.00 in relocation assistance in the end without the short sale options of HAFA or programs provided by Freddie Mac or Fannie Mae. After a particularly trying financial hardship, the relocation assistance they received made it possible for them to piece their lives back together. And, following their amazing story, the Guldi Group’s approach to the client’s plight inspired similar actions in other agencies.

Early on, when other real estate agents looked at the Guldi group agent responsible for this success story like he might be wasting his time with distressed transactions, he kept pushing forward. The new path that’s opened itself up for impacted homeowners wasn’t present outside of restrictive HAFA parameters before this. Chris completed his first short sale in 2001, and it’s been his main area of expertise ever since. He expresses that he “enjoys helping people through a difficult time,” and that’s why he continues to focus on clients whose financial hardships have them facing the loss of their homes. Banks have begun to grasp the wisdom in working with short sales, and we’re now seeing the beginnings of a trend that could end the need for foreclosure in situations that are beyond the control of the hard working families straining under the potential loss of properties they’ve made payments on for years (and even decades).

The power of short sales and Deed-in-Lieu programs is their ability to prevent the “dark mark” from appearing on the credit reports of impacted homeowners. Their credit is still affected to a degree, but neither option devastates credit ratings like a foreclosure. These program options are lifesavers, but they aren’t always accessible to distressed homeowners. Homeowners who have remortgaged their properties, for instance, may not qualify for either option under HAFA regulations.

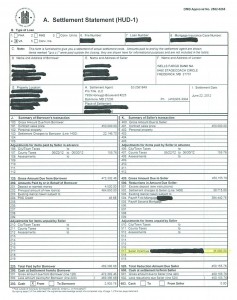

While receiving a $35,000.00 relocation check isn’t standard, it can and does happen. Chris has gone on to help hundreds of struggling homeowners with his understanding of foreclosures and short sales. He has a short sale specialist and a dedicated partner who processes short sales exclusively reserved to work with clients who are interested utilizing it as an option to avoid the weight of foreclosure. The Guldi Group knows the “ins and outs’ of short sale transactions, and they take relocation assistance matters very seriously. They’re determined to ensure their clients are able to keep their credit in good standing, and they’re aware that relocation costs require money that their clients may not have.

When struggling families find their feet again, they deserve another chance to own a home. There are no fees for the short sales the Guldi Group’s clients express interest in, and clients won’t need to vacate their home during the short sale period. The strain this lifts off of the shoulders of impacted property owners is tremendous. And, thankfully, it’s been demonstrated that homeowners who don’t qualify for government programs can utilize other ways to engage in a short sale, and receive moving assistance. The story of the $35,000.00 check that was cut for the Maryland family who came to the Guldi Group for help offers property owners a great deal of hope.