CoreLogic, an information and analytics provider, announced today/yesterday that 11.1 million or 22.8% of residential properties with a mortgage in the U.S. were underwater at the end of the fourth quarter of 2011.

CoreLogic report shows that at the end of the fourth quarter of last year out of 1,360,309 residential properties with mortgage in Maryland, 331,159 were underwater or 24.3%, while 68,794 or 5.1% were near underwater.

The underwater residential properties nationwide are up from 10.7 million properties or 22.1 percent in the 3rd quarter of last year.

During the last quarter of last year, CoreLogic tracked close to 48 million properties with a mortgage. These 48 million properties represent over 85% of all mortgages in the U.S.

Underwater, also known as negative equity, occurs when borrowers owe more on their mortgages than their homes are worth. Underwater can happen due to an increase in mortgage debt, decline in home value or a combination of both.

“Due to the seasonal declines in home prices and slowing foreclosure pipeline which is depressing home prices, the negative equity share rose in late 2011. The negative equity share is back to the same level as Q3 2009, which is when we began reporting negative equity using this methodology,” Mark Fleming, chief economist with CoreLogic, said in a statement published in CoreLogic website.

Fleming continued, “The high level of negative equity and the inability to pay is the ‘double trigger’ of default, and the reason we have such a significant foreclosure pipeline.”

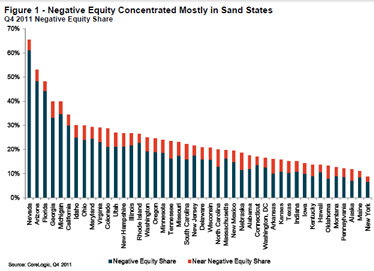

CoreLogic report shows that underwater properties in the last quarter of 2011 were concentrated mostly in the sand states. The following states have the highest underwater percentage: Nevada with 61% of its mortgaged properties underwater, followed by Arizona (48%), Florida (44%), Michigan (35%), Georgia (33%), California (29.9%), Idaho (25%), Maryland (24.3%), Ohio (23.9%) and Virginia (23.0%).

The report added, “Of the 11.1 million upside-down borrowers, there are 6.7 million first liens without home equity loans. This group of borrowers has an average mortgage balance of $219,000 and is underwater by an average of $51,000 or an LTV ratio of 130 percent.”

Whether you are a first-time home buyer, first-time home seller, empty nester, thinking about selling a home or buying a home, do contact the Guldi Real Estate Group. In Southern Maryland, the Guldi Group is the number one real estate team.